As we entered 2023, the direct influence of COVID-19 on the protection market subsided significantly. However, other factors meant that the market faced a different set of challenges: international conflicts, sustained inflationary pressures, an upward interest rate trajectory and cost of living challenges have all influenced the underlying performance of the protection market over the last 12 months.

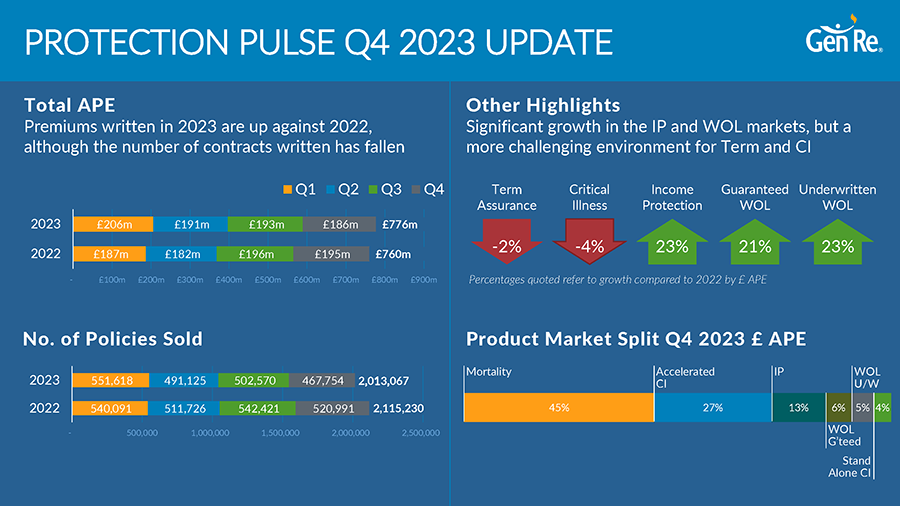

Despite this uncertainty, overall protection market premiums grew 2%. The £776 million of total premiums was the second-highest level since Protection Pulse reporting began, just eclipsed by the overall record of £779 million seen in 2019. The number of contracts has fallen slightly, but we have observed a higher average case size.

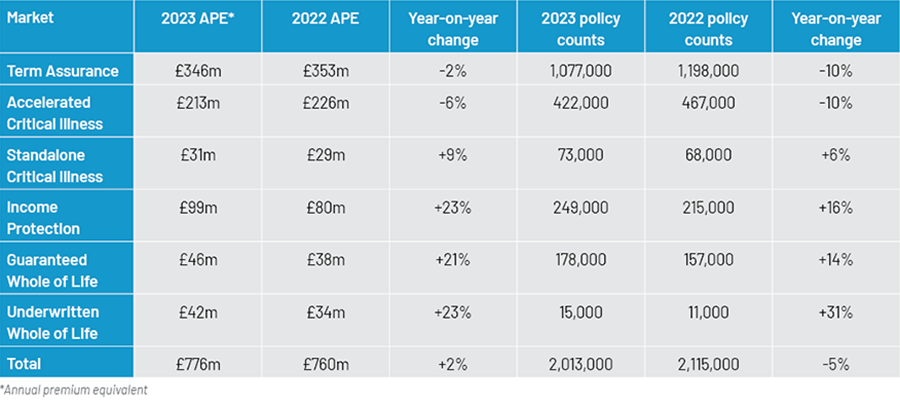

Our Protection Pulse1 survey shows that the performance across 2023 varied by contract type, as can be seen in Table 1.

Table 1: Full year 2023 performance by market

The income protection (IP) market has enjoyed another year of strong growth, continuing on from the increases seen across 2021 and 2022. In Q4 2023 £26 million of IP premiums was written, the highest levels recorded since Protection Pulse reporting began. The growth in premiums exceeds the increase in number of contracts written, potentially fuelled by high levels of earnings growth in the employment market, and inflation driving larger indexation increases.

Underwritten and guaranteed acceptance whole of life (WOL) markets have both performed well in 2023, with premiums and contracts written significantly higher than 2022. Indeed, the underwritten WOL market saw the highest levels of premiums written since 2015. The guaranteed acceptance WOL figures have partially recovered from 2022 levels but remained well below pre-COVID-19 pandemic levels. One of the factors behind the growth for both WOL markets would be the higher yields seen in 2023, which enables providers to price these products more competitively.

Term assurance has had a contrasting year: the premiums written in H1 2023 showed a 5% increase compared with H1 2022 levels, but there was a significant slowdown over the second half of the year, with premiums written down 8%. Overall, there was a reduction of 2%. The fall in the number of contracts written is even more pronounced, with a reduction of 10%. In addition, there was also a reduction in the proportion of contracts classified as “mortgage-related” business. It would appear that the impact of sustained mortgage rate increases and the pressures this has placed on consumer finances has filtered through into the term assurance market.

The Critical Illness (CI) market struggled in 2023, with overall premiums down 4%. The shift from accelerated CI to standalone CI continues, with a reduction in accelerated CI of 6% partially offset by an increase in standalone CI of 9%. The slowdown in the housing market will have played a part in this.

The Bank of England uses interest rates as a way of controlling inflation, and interest rates have increased significantly over 2023. There are signs that inflation levels are reducing, with further interest rate increases appearing less likely. However, the full impact of interest rate increases takes time to emerge, given the prevalence of fixed rate mortgages in the housing market. As the mortgage market drives protection sales, we expect the wider macro-economic environment to continue to exert significant influence over the protection market over the next 12 months.

Gen Re will continue to provide insights from the UK protection market, and report on the emergence of any new trends.

Endnote

1. Gen Re’s Protection Pulse survey gathers new business sales from all the major writers of insurance in the UK protection market

Disclaimer

The contents of this Protection Pulse market summary are observations made by Gen Re based upon information available at the time. This report does not constitute professional advice and recipients should seek their own advice if they consider it necessary to do so. Gen Re assumes no liability whatsoever for the contents of this report or any reliance placed upon its contents by a recipient.

This report is the copyright of Gen Re and may not be reproduced and distributed without the express permission of Gen Re.