The ever-evolving protection market landscape changed once more as we entered into 2023. The COVID-19 lockdowns that impacted the protection market in previous years have given way to economic challenges, with rising interest rates and sustained high levels of inflation placing a heavy burden on consumer finances.

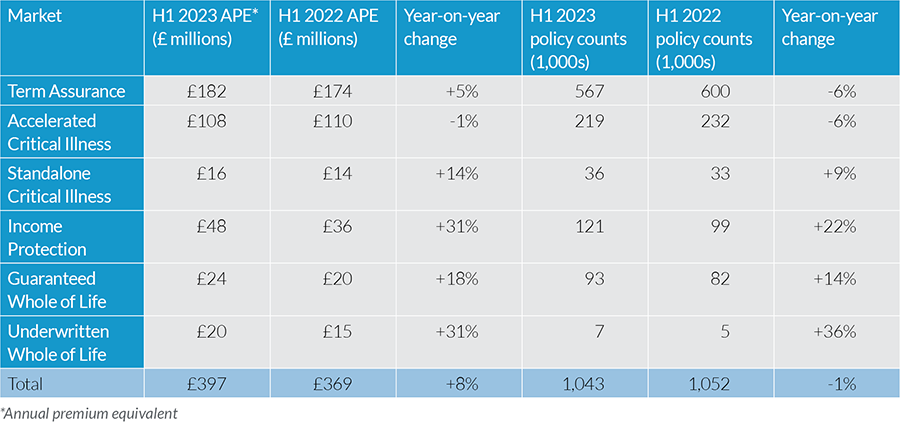

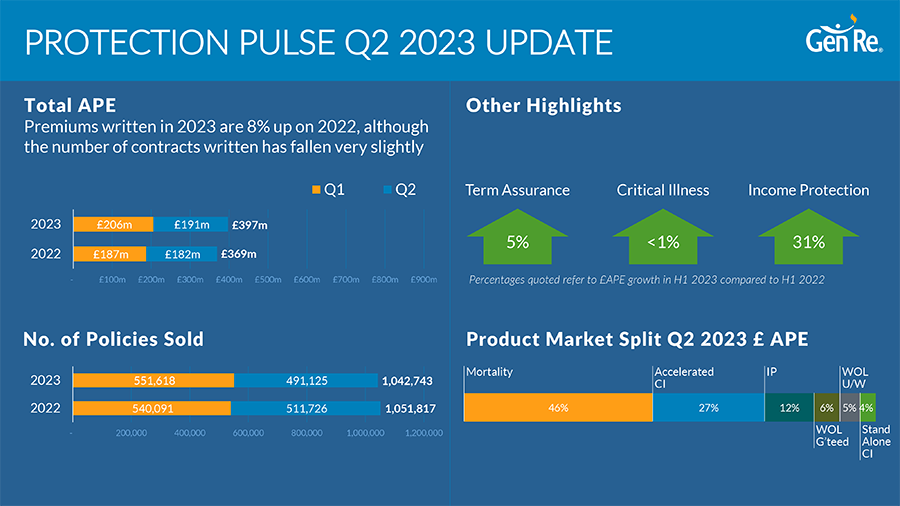

Despite this uncertainty, the protection market has performed well over the first half of the year, with premiums written up around 8% overall in H1 2023 compared with H1 2022. The number of contracts has fallen slightly, leading to a higher average case size. Our Protection Pulse1 survey shows that the performance in H1 2023 varies by contract type, as can be seen in the table below.

The income protection (IP) market has enjoyed another strong start to the year, following on from the sustained growth seen across 2022. In Q1 2023 £24 million of IP premiums were written, the highest levels recorded since Protection Pulse reporting began. The growth in premiums exceeds that of the number of contracts written, driven potentially by high levels of wage growth in the employment market.

Underwritten and guaranteed acceptance whole of life (WOL) markets have both performed well during H1 2023, with premiums and contracts written significantly higher than H1 2022. The underwritten WOL market saw the highest levels of premiums written since 2016. The guaranteed acceptance WOL figures recovered somewhat from 2022 but remained well below pre-pandemic levels. The increase in yields driven by wider economic pressures is beneficial to WOL contracts, giving providers scope to price these contracts more keenly to attract new customers and grow the market.

The term mortality market showed a small increase in premiums written, almost 5% higher in H1 2023 compared to H1 2022, but still slightly below the record levels seen in H1 2021. The number of contracts written has fallen almost 6% between H1 2022 and H1 2023. The number of mortality contracts classified as mortgage-related in our survey has fallen for the last three quarters and coincides with a slowdown in the housing market caused by higher mortgage rates.

Critical Illness (CI) market premiums have remained relatively stable in H1 2023, although the ratio of standalone CI premiums compared to accelerated CI premiums continues to grow.

The cost-of-living crisis is likely to continue to affect consumer spending habits, particularly as the full impact of the multiple interest rate rises begins to be felt in the property market, and this may impact future protection new business sales.

Gen Re will continue to monitor the protection market, and report on the emergence of any new trends.

Endnote

1. Gen Re’s Protection Pulse survey gathers new business sales from all the major writers of insurance in the UK protection market.

Disclaimer

The contents of this Protection Pulse market summary are observations made by General Reinsurance based upon information available at the time. This report does not constitute professional advice and recipients should seek their own advice if they consider it necessary to do so. Gen Re assumes no liability whatsoever for the contents of this report or any reliance placed upon its contents by a recipient.

This report is the copyright of Gen Re and may not be reproduced and distributed without the express permission of Gen Re.