In 2024 the Protection market evolved in response to a somewhat revised environment. The acute impacts of COVID-19 and the cost of living pressures of the more recent period had eased, with consumers adjusting to a changed economic environment amid higher interest rates and inflation rates than those they may have been used to.

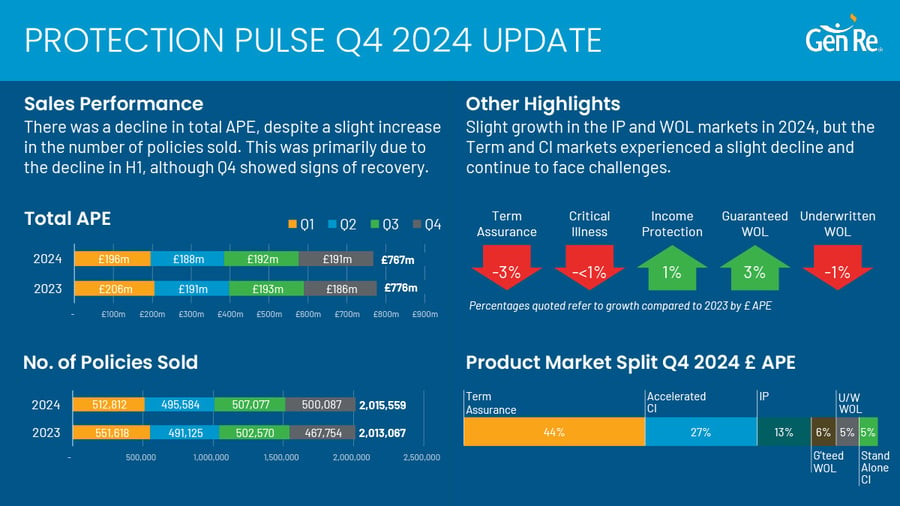

After a strong performance in 2023, our Protection Pulse1 survey shows that the Protection market experienced a very slight decline: total market premium fell by 1% over the year, with the market comparable to premium volumes from 2021. Performance within the year did vary: the year began with a challenging first half, with premiums falling by 3.3% compared to 2023, but a recovery in the second half of the year – driven by a 2.5% increase in volumes in the fourth quarter – led to a market with premiums broadly equal over both parts of the year.

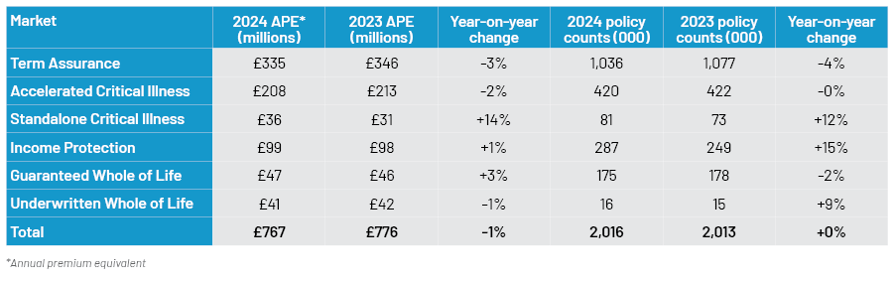

The overall market was broadly flat, but performance by contract type did vary, as can be seen in Table 1.

Table 1: Full year 2024 performance by market

In contrast to premium volumes, the number of policies sold increased slightly. Ordinarily, this would suggest a reduction to average policy sizes, but the inflation context of the last few years does need to be considered: the lower level of inflation in 2024, compared to 2023, led to smaller increments for policies that are linked to inflation, which for some lines of business – notably Income Protection (IP) and Underwritten Whole of Life (UWOL) – can be quite material.

IP continues to be a standout performer, with a 15% increase in the number of policies sold. This growth highlights a continued growing awareness of the need for financial security.

However, despite this sharp rise in demand, total premium value increased by only 1% over the year. This was driven by a combination of factors, again including the impact of inflationary increments and how much smaller they are this year compared to previous years. Consumers’ purchasing preferences would also have had an impact on this.

The Term Assurance market declined by 3.1% compared to 2023, with a drop of 7.8% in the first half of the year. However, there was a rebound in the second half when premiums grew by 2.2%. The reduction in mortgage rates and increased property listings in the latter half of the year probably contributed to the recovery we have seen in the Term Assurance market. As borrowing became more affordable, mortgage-related Protection products also regained traction.

The Critical Illness (CI) market remained flat in 2024, mirroring 2023 levels. However, the ongoing shift from accelerated to standalone CI continued, with accelerated CI declining by 2% and standalone CI growing by 14%. The drop in accelerated CI aligns with the decline in the Term Assurance market, as accelerated CI is often linked to mortgage-related sales. The rise in standalone CI reflects a growing preference through some distribution channels for more flexible, standalone coverage options and people purchasing a combination of products of different sum-assured sizes through menu-based products.

In 2024 the Underwritten Whole of Life (UWOL) market experienced a slight decrease of 0.6% in annual premium equivalent (APE) compared to the previous year, but the number of policies sold increased by 9%. In contrast, the Guaranteed Whole of Life (GWOL) sector has experienced stable growth in premium throughout the year.

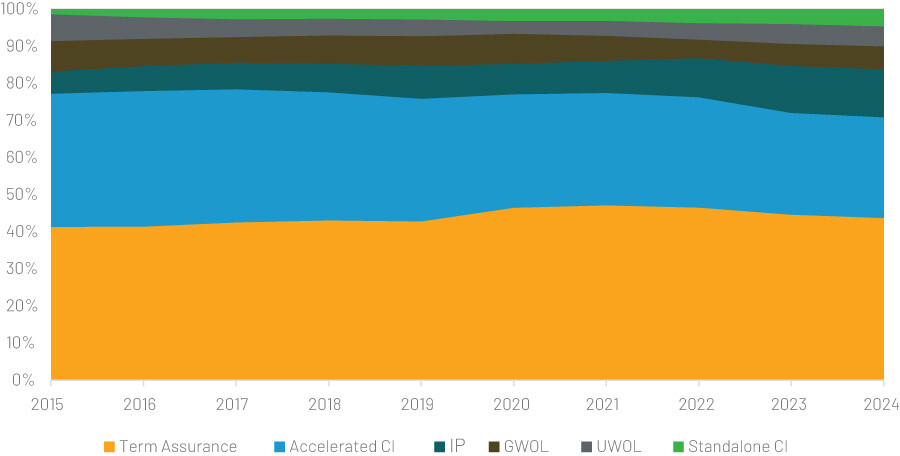

As illustrated in Figure 1, IP continues the trend of becoming a larger part of the Protection market, with the accelerated CI product becoming less important. The market, however, remains dominated by Term Assurance, which still accounts for over 40% of the market.

Figure 1: Market share of Protection products, 2015-2024

In 2025 the UK Financial Conduct Authority will be carrying out a review of the distribution of the Pure Protection Market. It’s possible that the outcomes of this may have an impact on premium levels and sales, given the focus on fair value. Gen Re will continue to provide insights from the UK Protection market, and report on the emergence of any new trends.

Endnote

1. Gen Re’s Protection Pulse survey gathers new business sales data from all the major writers of insurance in the UK Protection market

Disclaimer

The contents of this Protection Pulse market summary are observations made by Gen Re based upon information available at the time. This report does not constitute professional advice and recipients should seek their own advice if they consider it necessary to do so. Gen Re assumes no liability whatsoever for the contents of this report or any reliance placed upon its contents by a recipient.

This report is the copyright of Gen Re and may not be reproduced and distributed without the express permission of Gen Re.