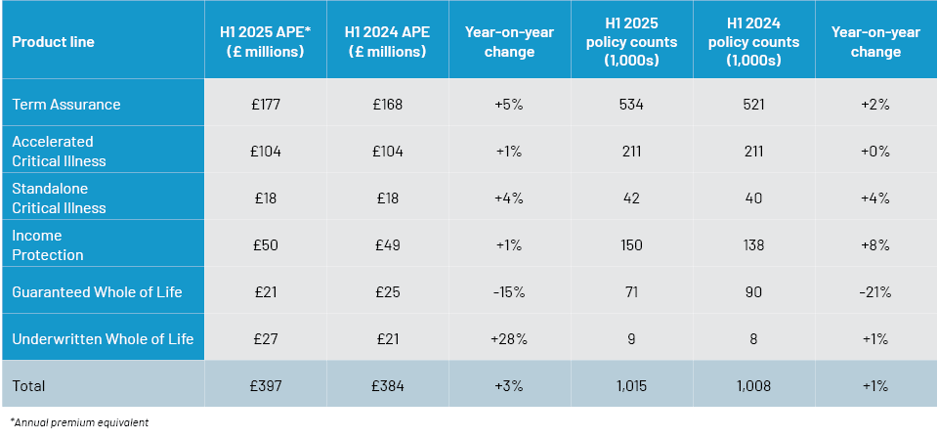

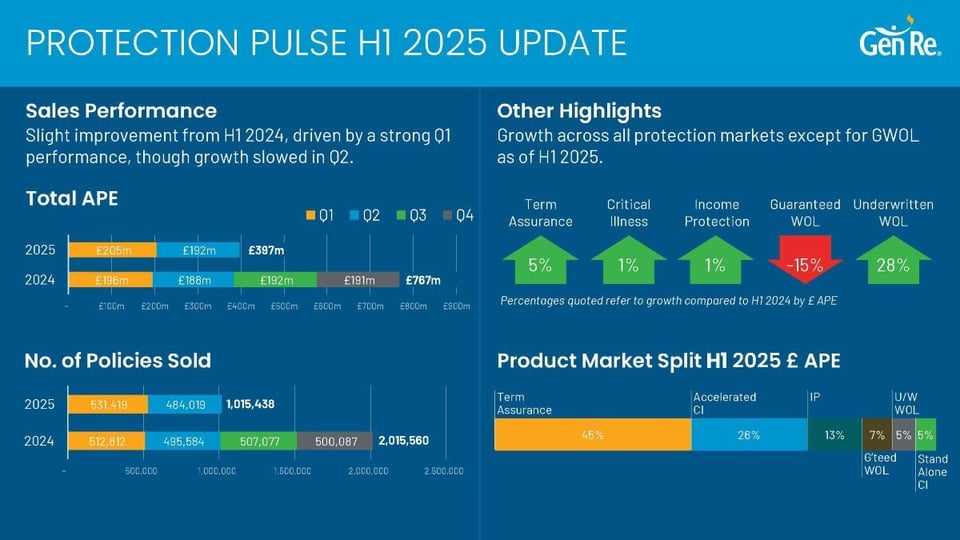

The overall market showed slight growth of about 3% by annual premium equivalent (APE) and about 1% by policy count in H1 2025 compared to H1 2024, with total market premiums at £397 million. This was mainly driven by robust growth in Q1, which then slowed in Q2. The growth by line of business is shown in Table 1.

Table 1: H1 2025 performance by product line

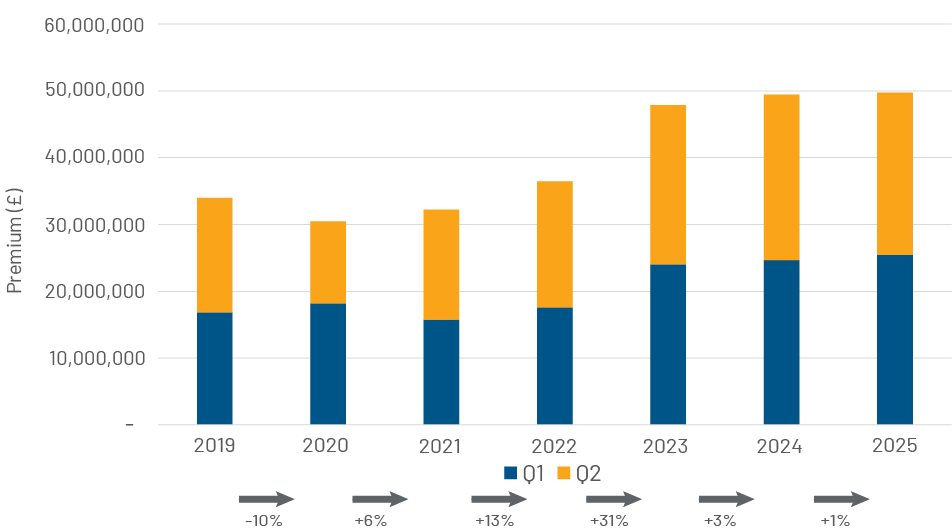

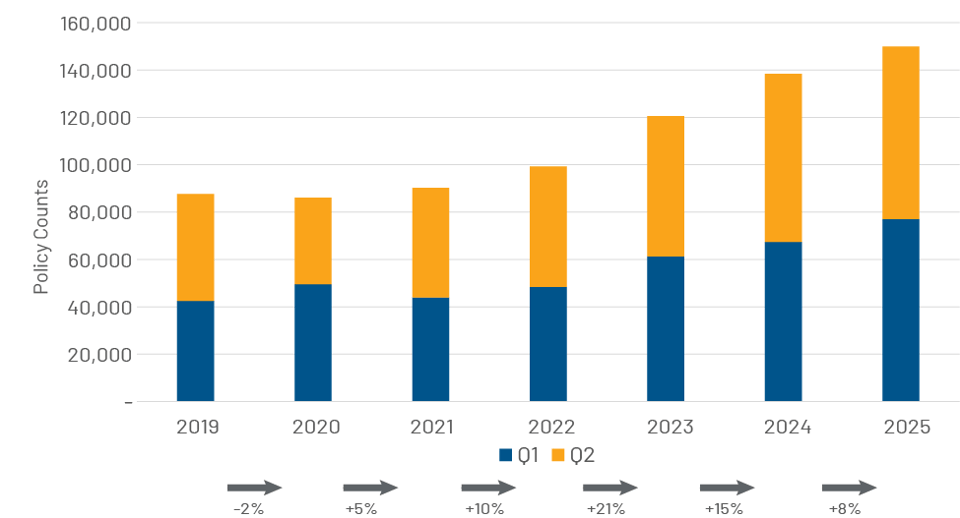

We continue to see a slowdown in the growth of Income Protection (IP) sales by APE, with sales rising by just 1% in H1 2025 compared to H1 2024. This is a similar pattern to what was seen in H1 2024, where sales increased by just 3% from H1 2023, which is a sharp contrast to the 31% growth seen in H1 2023 compared to H1 2022. While the APE growth has been marginal, the growth in the number of policies continues, with policy count increasing by 8% in H1. To highlight this shift, we have presented the APE and policy count growth over the last six years in the following two graphs:

Income Protection (APE)

Income Protection (Policy Counts)

The relative difference in growth rates may be down to increased engagement from younger customers and hence an increase in policy count. A 2024 study conducted by ELEOS stated “Our demographic analysis reveals a significant shift in the age distribution of IP policyholders, particularly when comparing recent purchasers (those who bought policies in the last two years) to those who purchased policies more than two years ago. Among those who became policyholders in the last two years, we observe a strong uptake of younger age groups.” 1 This demographic may be likely to take out policies with lower sums assured than those in the older age group to whom insurers have traditionally sold IP policies.

If this is one of the drivers of increased sales by policy count, this certainly would be very encouraging for the industry, where there have been significant efforts to engage the younger demographic.

IP products can be perceived as expensive, particularly when compared to more straightforward Life cover options. Looking back to the 12 months to January 2024, many households were still grappling with the cost-of-living crisis, and discretionary spending on long-term financial products was being scaled back.2 This may have contributed to a move towards shorter payment periods for IP, with customers wanting some cover rather than none. Regardless of the underlying reason, it’s disappointing to see the substantial slowdown in growth we have observed.

In contrast to IP business, Underwritten Whole of Life policies are experiencing strong growth by APE in H1 2025 compared to H1 2024, largely driven by a renewed emphasis on Inheritance Tax (IHT) planning following recent budget changes. With upcoming reforms set to include pensions in the IHT calculation and reductions in reliefs on business and agricultural assets, many individuals are seeking reliable ways to protect their estates from tax liabilities. Additionally, rising property values3 have increased the urgency for effective estate planning, further boosting demand for Whole of Life coverage. The number of policies remains stable from H1 2024, indicating a rise in the level of sum assured per policy.

Sales of Guaranteed Whole of Life policies are declining as concerns grow over their long-term value, particularly in light of the Financial Conduct Authority’s (FCA) ongoing Pure Protection Market Study, which has a significant focus on the Guaranteed Whole of Life product. This review will examine, among other aspects, whether products offer fair value4, and whether the products are mis-sold due to the commission offered.5

Critical Illness insurance has stabilised, with the accelerated version of the product stemming the recent fall in sales and reporting a very modest growth. The standalone version continued its upwards trajectory with increases by both policy count and APE. Google Trends shows that online searches for ‘Critical Illness Insurance’ in the UK have increased in H1 2025 compared to H1 20246 which points to an increased awareness of serious health conditions and the need for this type of protection.

Term Assurance sales in H1 2025 increased 2% by policy count and about 5% by APE compared to H1 2024. The growth seems to be driven by the mortgage market, with our data showing an increase in term assurance being used to protect mortgages. The FCA’s mortgage lending statistics are also showing a substantial increase in mortgage advances: Q1 2025 was 54% higher than Q1 2024.7

The Outlook for H2 2025

Life insurers are likely to face a range of evolving challenges, trends and opportunities that could reshape their business landscape. With the aforementioned IHT pressures mounting, we are likely to continue to see an increased demand for Underwritten Whole of Life policies. This raises the question: will Joint Life Second Death policies continue to gain popularity as couples look for efficient estate planning solutions? Will we continue to see the increasing trend in mortgage lending and, if so, will we see the positive effect on the term assurance market?

Further, insurers will need to watch regulatory developments, changing consumer behaviours, and technological advances carefully to adapt and thrive in this dynamic environment. Gen Re will continue to share insights from the UK Protection market and highlight any emerging trends.

Endnotes

1. Study by ELEOS of over 800 Income Protection policyholders in the UK: ‘Why are Sales of Income Protection Insurance Growing?’ Charlotte Anderson. 8 October 2024. https://partner.eleos.co.uk/resources/insights/sales-of-income-protection-insurance-growing

2. FCA Publication ‘Financial Lives cost of living (Jan 2024) recontact survey.’ Published 10 April 2024. https://www.fca.org.uk/publications/financial-lives/jan-2024-recontact-survey-summary#:~:text=22%25%20(11.8m)%20of,6%20months%20to%20January%202023

3. UK Government Price Index for June 2025. Published 20 August 2025. https://www.gov.uk/government/news/uk-house-price-index-for-june-2025

4. FCA Press Release ‘FCA announces work into pure protection market.’ Published 28 October 2024. https://www.fca.org.uk/news/press-releases/fca-announces-work-pure-protection-market

5. FCA Press Release ‘FCA to scrutinise whether pure protection market provides fair value to consumers.’ Published 21 March 2025. https://www.fca.org.uk/news/press-releases/fca-scrutinise-pure-protection-market-provides-fair-value-consumers#:~:text=premiums%20are%20being%20raised%20by,Terms%20of%20Reference%20(PDF)

6. Google Trends online search for ‘Critical Illness insurance’ in the UK. https://trends.google.com/trends/explore?date=2024-01-01%202025-06-30&geo=GB&q=%2Fm%2F09bdh1&hl=en-ZA

7. FCA Mortgage Lending Statistics to Q1 2025. Published 10 June 2025. https://www.fca.org.uk/data/mortgage-lending-statistics

Disclaimer

The contents of this Protection Pulse market summary are observations made by General Reinsurance based upon information available at the time. This report does not constitute professional advice and recipients should seek their own advice if they consider it necessary to do so. Gen Re assumes no liability whatsoever for the contents of this report or any reliance placed upon its contents by a recipient.

This report is the copyright of Gen Re and may not be reproduced and distributed without the express permission of Gen Re.

While we don’t expect these results to change materially, they are subject to revision pending final data receipt.